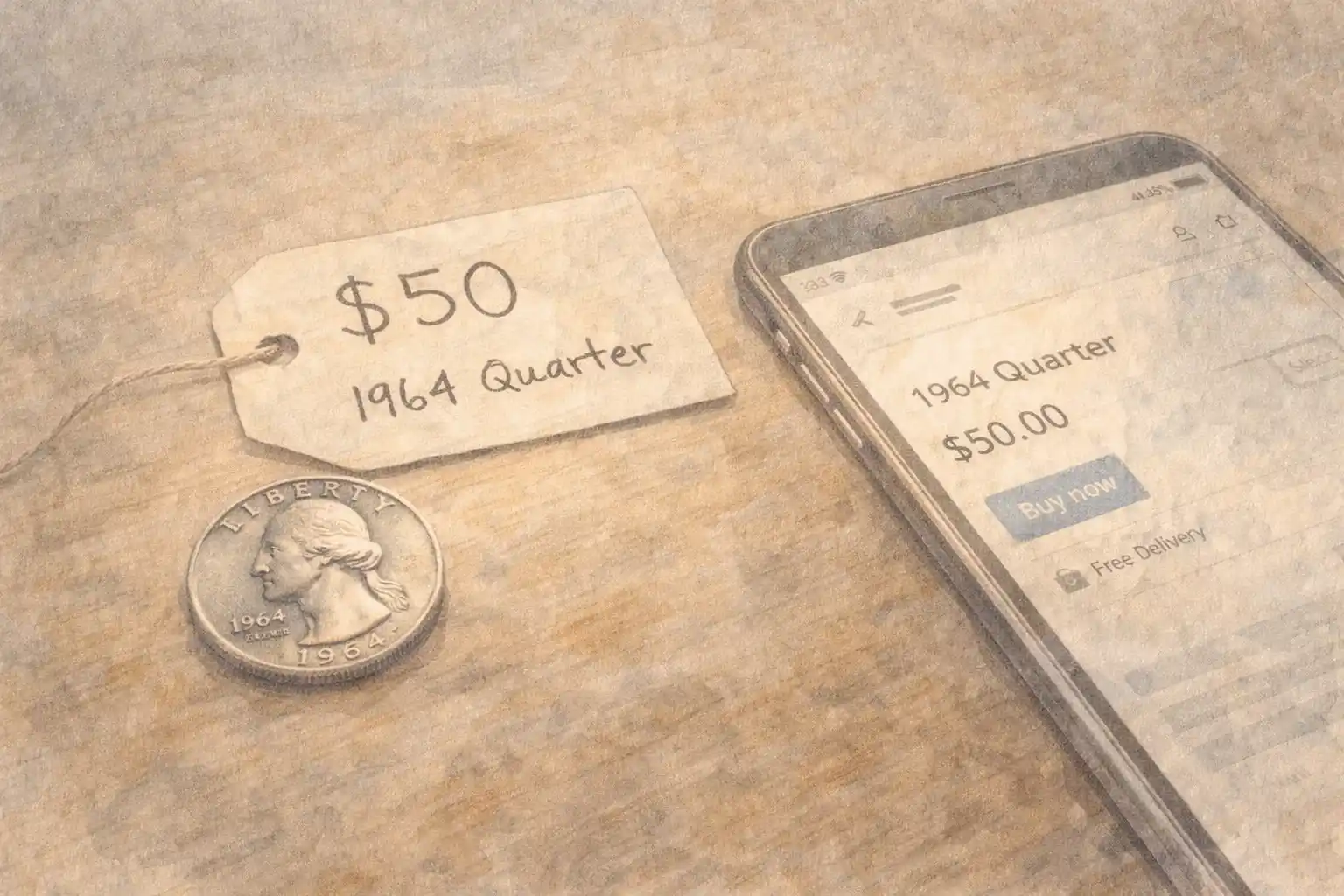

Should You Pay a Lot for a 1964 Quarter? When Yes, When No

The 1964 Washington quarter occupies a strange space in the U.S. coin market. It is historic, silver, widely recognized, and easy to find—yet only a tiny fraction justify high prices. That contrast causes confusion. Some sellers push raw coins at inflated premiums. Others dismiss the issue entirely, overlooking genuine opportunities.

Context matters. The 1964 quarter was the final year of 90% silver circulation coinage before the composition shift to copper-nickel. That alone guarantees baseline value. At the same time, the United States Mint produced more than 1.26 billion pieces across Philadelphia and Denver. Supply remains massive.

The result is a split market. Most examples behave like bullion. A small percentage perform like true numismatic assets. Paying a lot only makes sense when a coin clearly falls into the second group.

Before grades, proofs, or varieties enter the picture, every decision starts with silver.

Silver Baseline Value: The Floor You Don’t Ignore

Every genuine 1964 quarter weighs 6.25 grams and contains 0.1808 troy ounces of pure silver. That metal content sets a firm value floor. In current market conditions, circulated examples trade around $10–$12, closely tracking spot silver prices rather than collector demand.

This applies to both major issues:

1964-P (no mint mark)

Approximate mintage: 560 million1964-D (Denver mint mark)

Approximate mintage: 704 million

In circulated grades such as XF40 to AU50, condition barely affects price. Wear differences are cosmetic, not financial. Paying above melt for raw circulated coins rarely makes sense unless a clear error or variety is present. Use the best free coin identifier app to avoid costly overpays at this stage.

Practical Buying Rules at the Silver Level

Use these guidelines to avoid overpaying early:

Raw circulated coins should stay near melt value

XF to AU pieces rarely justify premiums above $15

Eye appeal does not equal scarcity at this level, and the best coin value app should help you to distinguish true gems.

“Old collection” stories do not increase value

Many beginners confuse age with rarity. In reality, millions of 1964 quarters survived decades of circulation. Without exceptional preservation, they trade like silver rounds, not collectibles.

This silver baseline is not a weakness. It provides downside protection. Even if collector demand softens, intrinsic metal value remains. That stability explains why 1964 quarters continue to move easily in both bullion and numismatic markets. The real question begins once silver value is no longer the main driver.

When Paying a Lot Makes Sense: Grades, Proofs, and Certified Scarcity

High prices for a 1964 quarter only make sense when scarcity replaces silver as the value driver. That happens in two clear situations: exceptional condition and verified proof quality. In both cases, certification is not optional. It is the difference between paying a premium and gambling.

Paying for High-Grade Business Strikes

Among more than a billion coins struck, very few survived with untouched surfaces. Bag marks, friction, and weak strikes eliminated most candidates early. Coins graded MS67 and higher exist in tiny numbers relative to mintage, and demand focuses almost entirely on these grades.

Collectors pay aggressively for coins certified by Professional Coin Grading Service or Numismatic Guaranty Company because the grade is guaranteed, consistent, and market-recognized.

Typical price behavior looks like this:

Certified Coin | Approx. Value | Why Buyers Pay |

MS65 | $25–$40 | Entry uncirculated |

MS67 | $465–$1,700 | Condition rarity |

MS68 (1964-D) | $20,000+ | Extreme scarcity |

The record price of $38,400 for a 1964-D MS68 illustrates the point. That result was not driven by silver, age, or nostalgia. It was driven by population rarity and verified surface quality.

Proof Coins: Controlled Supply, Clear Upside

Proof 1964 quarters follow a different logic. Struck in Philadelphia with polished dies and planchets, they were never intended for circulation. Most survive, yet top-tier examples remain scarce due to handling, haze, and improper storage.

Collectors pay premiums for proofs with:

deep mirrored fields

strong frosted devices

clean surfaces free of hairlines

Proof Grade | Typical Range | Market Driver |

PR69 DCAM | $144–$408 | Visual contrast |

PR70 | ~$300+ | Perfection standard |

These prices remain stable because demand comes from registry collectors and long-term holders, not silver buyers.

Special Cases That Justify Premiums

Beyond grades and proofs, a few recognized varieties justify paying more even at lower grades:

Type B Reverse (proof reverse used on business strike)

Strong doubled dies with clear lettering separation

Verified repunched mint marks

In these cases, paying $100–$400 can be justified if attribution is confirmed and surfaces are original.

For quick screening before committing to grading or auction prices, some collectors use Coin ID Scanner. Photo-based identification helps confirm year, mint, weight, and composition, making it easier to reject overpriced raw coins early.

Paying a lot only works when evidence replaces assumption. Certification, population data, and documented auction results form the foundation. Without them, even a shiny coin remains just silver.

When to Say No: Common Traps, Smart Exceptions, and Final Buying Logic

Most mistakes with 1964 quarters happen at the middle of the market. Prices look modest. Claims sound convincing. The coin appears shiny. That combination leads buyers to overpay for pieces that will never outperform melt value.

Situations Where Paying a Premium Fails

Several red flags appear again and again. Ignoring them almost always leads to losses.

Raw “gem” coins priced above $20

MS63–MS65 examples are extremely common. Grading fees often exceed the coin’s resale value.Cleaned or polished quarters

Hairlines, dull shine, or unnatural brightness cut value by half or more, even in higher grades.Unverified doubled dies

Many sellers label machine doubling or strike bounce as rare errors. Real doubled dies show clear, rounded separation.Story-based pricing

Phrases like “from an old estate” or “never cleaned” do not replace certification or diagnostics.

At this level, the market is flooded. Supply overwhelms demand. Paying extra offers no advantage.

Errors and Varieties That Change the Equation

There are moments when paying above melt makes sense outside of top grades. These depend on verification and clarity, not optimism.

Green-light varieties include:

Doubled Die Obverse (FS-101)

Strong doubling in “IN GOD WE TRUST”

Typical value: $145–$250Doubled Die Reverse

Clear separation on lettering

Range: $40–$2,000 depending on strengthRepunched Mint Marks (RPMs)

Well-defined secondary punch

Often $450 and higher in problem-free conditionOff-center or clipped planchets

Minor premiums of $20–$150 when genuine

These coins demand close inspection, weight checks, and sharp photos. Raw errors without diagnostics carry risk. Certified examples reduce that risk dramatically.

For initial screening, many collectors rely on Coin ID Scanner. The app compares photos against a database of 187,000+ coins, confirming mint year, composition, diameter, and weight. That process helps eliminate overpriced common strikes before deeper research or grading costs.

Where to Buy with Confidence

Safer buying environments share two traits: transparency and completed sales data.

slabbed coins from major auctions

verified listings with certification numbers

past sale comparisons from Heritage or eBay sold results

Avoid paying “hope premiums” on raw coins. The math rarely works.

Final Verdict: Pay Big Only with Proof

A 1964 quarter deserves a high price only when evidence supports it. That evidence comes from:

certification

population rarity

recognized varieties

documented auction performance

For everything else, silver value sets the limit. Patience protects capital. Discipline creates opportunity. In a market this deep, walking away often proves smarter than paying up.